Travel and Expense

Generational Perspectives on Business Travel and What They Mean for Businesses

Do generational differences exist in the workplace, and if so, do they matter?

OK, that is a question that is far too large and complex for us to address in a single blog post. However, the results of 2022’s SAP Concur Global Business Travel Survey suggest that the four primary generations comprising today’s workforce—baby boomers, Gen X, millennials, and Gen Z—may have some differing expectations regarding business travel.

Although their perspectives vary, their needs can likely be addressed with relatively wide-sweeping solutions. Here's what our survey found, and how we recommend business leaders and travel managers use this information to guide their next steps:

All generations are enthusiastic about returning to business travel and generally want to travel more

Our survey found that nearly all respondents across generations (98%) are largely willing to travel for business over the next 12 months. However, Gen Z is less likely to be “very willing” at 43%, compared to 55% of millennials, 56% of Gen X, and 55% of baby boomers.

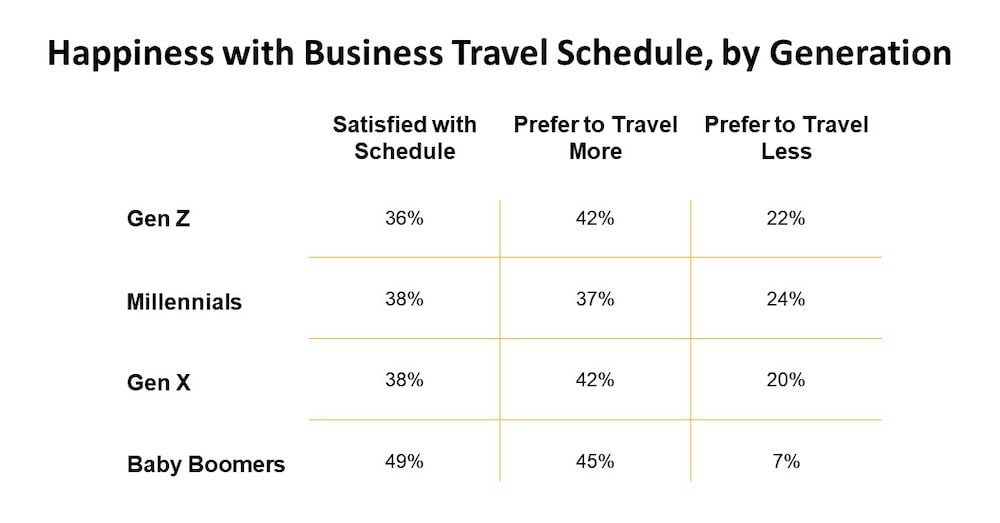

Of note, when it comes to current business travel schedules, baby boomers are most likely to be satisfied (49%) or would prefer to travel more (45%). Only 7% of them would prefer to travel less than they are.

How to use this: Most employees, regardless of generation, are open to travel, but the amount of travel that they expect may vary. Leaders should have honest conversations with business travellers about their willingness, desired schedule, and what might be holding them back.

Health and safety expectations differ between younger and older generations

Gen Z (94%) and millennials (94%) are more likely than Gen X (86%) and baby boomers (82%) to consider some flexible travel and booking options as essential for their company to allow to protect their health and safety when they travel for business.

Additionally, the top essential requirement for health and safety generally differs by generation:

- Gen Z expect to select their preferred mode of travel (37%) and book their travel directly on supplier websites (37%), such as airlines and hotels.

- Millennials expect to select their preferred accommodations (47%).

- Both Gen X and baby boomers expect to select their preferred mode of travel (46% and 44%, respectively).

How to use this: Employee expectations will vary. Travel managers can get ahead of this by tailoring travel policies with an eye toward overall flexibility, to best address the health and safety needs of most business travellers.

Younger generations feel slightly more empowered to decline a business trip that doesn’t match their expectations

Although 91% of business travellers, regardless of generation, would consider declining a business trip, Gen Z (96%) and millennials (93%) are somewhat more likely than Gen X (88%) and baby boomers (82%).

The top reason to consider declining is having safety concerns about travelling to certain parts of the world (53%), although Gen Z (46%) and baby boomers (48%) are just slightly more willing to take the risk than millennials (55%) and Gen X (53%).

How to use this: Reasons that employees would decline a business trip span the personal (e.g., needing a break) to the global (e.g., COVID-19 concerns), and employers that remain flexible and understanding are likely to come out ahead in the competition for talent. Leaders should make this part of their conversations with business travellers and be open to assessing things on a case-by-case basis.

Sustainability matters, especially among younger employees

While sustainability is a consideration across generations, it appears most important to Gen Z and millennial business travellers. For instance:

- Gen Z (22%) and millennials (28%) are more likely than Gen X (18%) and baby boomers (12%) to consider declining a business trip if it requires using non-sustainable travel options.

- Also, 98% of Gen Z and 96% of millennials plan to take steps to reduce their environmental impact while travelling for business over the next 12 months, compared to 92% of Gen X and 80% of baby boomers.

How to use this: Offering sustainable travel options and helping employees make informed choices is rapidly becoming a requirement for businesses. On the fence? Bear in mind its importance for younger employees and the impact of losing them to competition. Sustainable practices can be both good for the planet and good for business.

Among those unhappy with their current travel schedule, Gen Z may be the one to watch

Based on our survey findings, among those who are unhappy with their current level of travel, Gen Z is the most likely to take action (63%) and the greatest flight risk (35%), compared to an average across generations of 46% and 23%, respectively.

On a related note, perhaps it’s their higher-than-average satisfaction with their current travel schedule (49% vs. 39%) or where they are in their careers, but baby boomers are slightly less likely to take a new position that requires more business travel (88% vs. an average of 97%). That said, those who would consider it are less likely to require lures like a larger salary, more vacation time, or the ability to work from home (75% vs. an average of 92%). Gen Z and millennials would largely need to be lured (both 95%).

How to use this: If looking to hire for roles that require business travel, the above considerations will be essential from an attraction standpoint. The overall benefits package will play a significant role—especially when it comes to hiring for more junior and mid-level positions.

For more business traveller responses to our fourth annual Global Business Travel Survey, access the broader findings in the global whitepaper or download the Australia and New Zealand specific business traveller report for local insights.

The SAP Concur Global Business Traveler Survey was conducted by Wakefield Research between April 28 and May 23, 2022, among 3,850 business travelers, defined as those who traveled for business three-plus times in the past 24 months, in 25 markets: U.S., Canada, Brazil, Mexico, LAC (Colombia, Chile, Peru, and Argentina), UK, France, Germany, ANZ region (Australia and New Zealand), SEA region (Singapore and Malaysia), China, Hong Kong, Taiwan, Japan, India, Korea, Italy, Spain, Dubai, Benelux (Belgium, Netherlands, and Luxembourg), South Africa, Sweden, Denmark, Norway, and Finland. Data has been weighted to facilitate tracking.