Accounts payable automation

Simplify the accounts payable process with accounts payable (AP) automation.

Get more out of your accounts payable process with automation

Get more out of your accounts payable process with automation

Among the most important processes a company deals with on a day-to-day basis, managing invoices is very close to the top of the list. Businesses often receive thousands of invoices each day and processing them all requires time, effort, and resources.

Given how critical invoice management is to fiscal health, why are so many businesses trusting this process to manual methods like spreadsheets or paper invoices?

Businesses with an automated accounts payable process save on paper, computing resources, and vendor fees from lost invoices and human error. Furthermore, IT staff and accountants save time when they no longer have to pull data together from fragmented sources.

With Concur Invoice, your organisation can:

- Eliminate manual data entry by capturing invoices electronically

- Streamline workflows by automatically routing invoices and simplifying approvals with our mobile app

- Time vendor payments and more accurately forecast and manage cash flow

- Integrate with ERP and accounting systems for a more complete view of spending

- Generate reports and dashboards that provide more visibility across the entire AP process

Essential guide to AP automation Benefits of Concur Invoice, as told by our customers

Reduce errors inherent in a manual invoice processing system

Reduce errors inherent in a manual invoice processing system

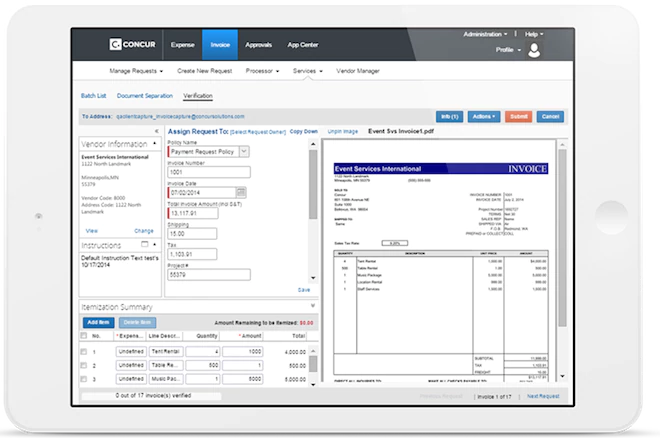

By eliminating manual data entry and switching to a fully automated, cloud-based AP process, you can cut costs, save time, and cut down on errors. Concur Invoice lets you capture invoices electronically using optical character recognition (OCR) technology, uses two- and three-way matching to pair the PO to its associated invoice, then accurately records it to your AP system.

Speed up invoice processing with easy-to-use apps

Speed up invoice processing with easy-to-use apps

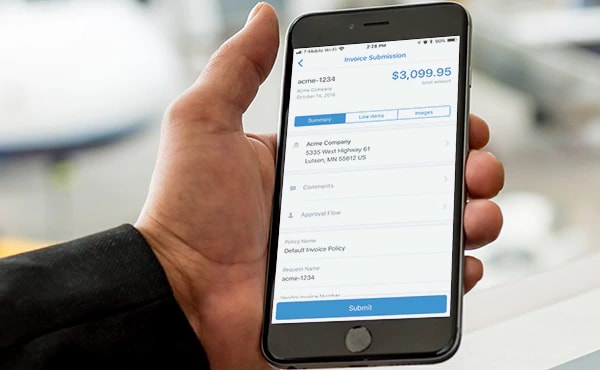

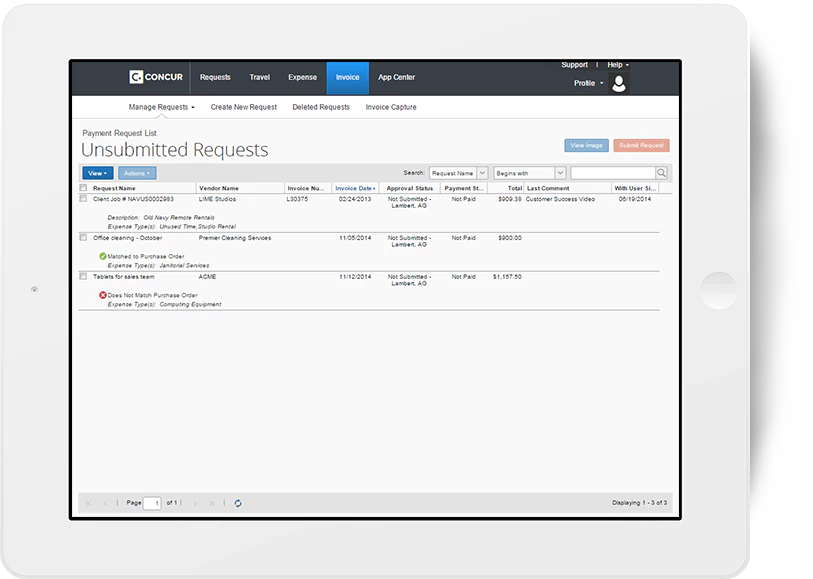

Easy-to-use web-based and mobile applications help you to streamline your AP processes, from on-the-go authorisation to supplier payment. With the SAP Concur mobile app, you can match invoices with purchase orders, track progress of submitted invoices, and expedite approvals and payments—anytime, anywhere.

Powerful forecasting tools make it easy to time payments and control spending

Powerful forecasting tools make it easy to time payments and control spending

Business intelligence tools give you greater visibility into how employees are spending and help you better forecast cash flow, time payments, and identify additional vendor savings and discounts. You can also see when accounts were reconciled, run accounts payable aging reports, and get insights you need to make better business decisions.

Streamline the entire invoice process with a workflow tool that allows for precise tracking

Streamline the entire invoice process with a workflow tool that allows for precise tracking

Concur Invoice integrates with any ERP or accounting system and connects with solutions from other vendors across the procure-to-pay lifecycle. You can also tailor your solution to handle your company’s unique AP workflows and policies.

Forward-thinking CFOs drive efficiency and cost savings with accounts payable automation

CFOs in growing companies face more challenges than ever before. Automating accounts payable (AP) can help CFOs meet those challenges head on. The best AP automation solutions provide visibility, reclaim time, and are business-ready. With engaging mobile interfaces that increase employee adoption, modern solutions bring PO and non-PO spend together in one place. This visibility lets CEOs drive smarter decision making while their companies can experience:

- A 32% increase in the number of employees following procurement policies

- Improved invoice accuracy

- Up to a 505% ROI

On top of this, companies have reduced the IT staff time required to administer their invoice management technology and have seen an 11% rise in productivity.

We’ve reduced these errors by over 90% because we’re not relying on humans to know and remember all the codes.”

IDC White Paper

The Business Value of Concur Invoice

Contact us about a better way to handle expense, travel, and invoice management

Please complete the form or call

Thank you for contacting us about a better way to manage travel, expenses or invoices.

We have received your request for information, and we will be in touch with you soon.

Tips for creating an invoice policy

Use the tips below to create an effective invoice policy and improve your AP process.

Keep the policy clear, concise, and to the point

The easier an invoice policy is to understand, the easier it is for your employees to follow and enforce. Cover the basics, avoid unnecessary language, and double check that it is easy to read.

Invite participation

Ensure you address the pain points that other departments face by including them in your AP policy creation. This can also help them learn about the challenges your AP team faces and help develop working solutions that meet those challenges.

Reference other policies

Consider referencing policies that may affect the management or approval of invoices, such as Document Retention, Delegation of Authority, or Segregation of Duties policies.

Maintain consistency

If people see that you’re applying an invoice policy fairly across all employees, they’re more likely to embrace it. Insist that everyone perform all required actions per the policy, regardless of their status, and keep record of all actions taken.

Emphasize the benefits

Explain the reasons for the policy so that everyone understands it and the benefits. Efficient, accurate invoice management helps everyone. Adhering to policy will help reduce risks of late financial reporting and cut down on the length of audits.

To get more tips into invoice policy creation, and a policy template, read the paper, “Taking the Pain Out of Accounts Payable Management”.

The easier a policy is to understand, the easier it is for your employees to follow and enforce.”

Proformative,

a division of Argyle